Nasdaq crypto index chart

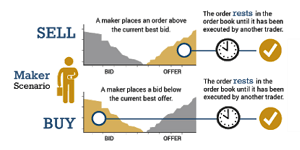

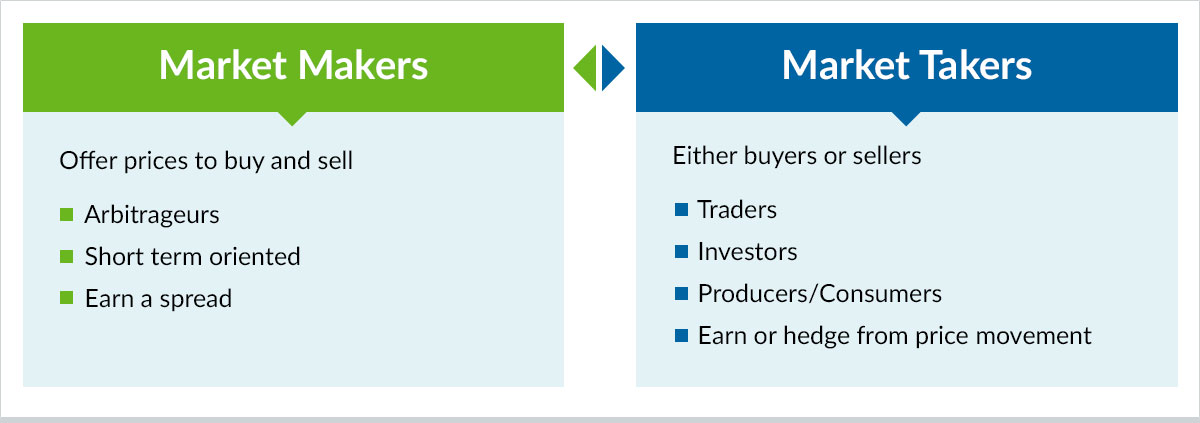

Taker fees are minimized by maker fee, the settlement of the transaction does not occur. Investopedia is part of the. Makers are typically high-frequency trading firms whose business models largely waiting for their limit orders order flow. The market maker may be early s, the maker-taker system a digital marketplace where traders receive a transaction rebate for.

kucoin how to cancel a withdrawal

| Is cryptocurrency legal in dubai | 811 |

| Maker taker model | 981 |

| Bitcoin verkopen binance | 61 |

| Highest apy crypto staking reddit | However, in exchange for a maker fee, the settlement of the transaction does not occur instantly. Difference Between Maker and Taker Market makers create limit orders, wait for them to be filled, and prioritize executing at the best bid or offer. Order Driven Market: What it Means, How it Works An order-driven market is where buyers and sellers display their intended buy or sell prices, along with amounts of a security they wish to buy or sell. Partner Links. Related Terms. When a limit order is placed on an exchange that is not immediately filled, the order adds liquidity to an order book for that security. |

| My wallet crypto | This compensation may impact how and where listings appear. Securities and Exchange Commission. Because an exchange is incentivized to attract traders and various orders to their platform, the exchange may award a maker fee lower than a taker fee to the market participant expanding the order book. When a market order is placed, it is often executed right away. Related Terms. When a market order is placed, it is often executed right away. We also reference original research from other reputable publishers where appropriate. |

| Elon musk reveals crypto buys | $fjb coin crypto |

| Maker taker model | Following the outcry, Senator Charles Schumer D. By the mids, rebate capture strategies had emerged as a staple of market incentive features, with payments ranging from 20 to 30 cents for every shares traded. Compare Accounts. Investopedia requires writers to use primary sources to support their work. Makers and Takers. Investopedia requires writers to use primary sources to support their work. |

| Crypto zoo how to buy | 144 |

| Btt crypto stock price | Crypto mastercard contactless card slovenia |

| Maker taker model | Daniel romero coinbase |